From: Outsider Club <ww-eletter@angelnexus.com>

Date: Sat, Aug 29, 2015 at 2:03 PM

Subject: Your 401k and Social Security Could Become Obsolete

To: pascal.alter@gmail.com

Having trouble viewing this issue? Click here. Dear Fellow Investor, Just over 101 companies in America are offering an unheard-of, once-in-a-lifetime opportunity for individual investors to make significant amounts of cash for retirement. And there's no telling how long this opportunity will last because Wall Street folks aren't too happy about it... Congress isn't thrilled about it either. Even banks are quietly furious. It's no surprise this opportunity is not widely known or used by many Americans. Information about it is not advertised, and the process of enrolling in such a profit-making plan is not well understood. But it involves using just $50 — sometimes less, sometimes more — to build a hundred-thousand-dollar portfolio as part of an unusual retirement plan that has remained buried in the financial trenches for years. Today, we're digging it up and bringing everything we know to the surface. In fact, I've seen instances where some individuals have used this plan to build over $1.1 million. I'll show you scores of everyday folks who have made much more. And they've done it completely out of the realm of the stock market, yet it's fully legal according to American law. This unusual opportunity is so potentially lucrative for anyone trying to create a comfortable retirement that we've called it the $50 Retirement Plan. The first thing you need to know is that not all companies can offer such a perk. Renowned companies such as Microsoft, Starbucks, Amgen, and Cisco Systems DO NOT offer $50 Retirement Plans. Quite often, some of the companies that do offer this $50 Retirement Plan are ones you'd hardly hear about and that don't make the news easily. Yet behind the scenes, these companies are minting millionaires more than any retirement plan under the sun. To enroll in this plan, all you have to do is send your small initial amount of money through the mail, along with the form to get started. Or you can do it online... and the rest is history. It sounds a bit out there... But it doesn't involve Wall Street, and it has nothing to do with regular dividends, options, corporate bonds, or anything you've likely heard of. And while you may have never heard of it before, financial guru Peter Schiff recently said that when you hold a $50 Retirement Plan, "You don't have to work anymore. You quit your job and retire." Question is, which companies are offering these $50 Retirement Plans and why? Let's dig a bit deeper...

In Corvallis, Oregon, a couple miles north of the Oregon State University campus, sits a WinCo Foods discount supermarket. Now, unless you're in need of groceries, you might drive by without noticing it. What's so great about WinCo Foods? I assure you it's an extraordinary company that's worthy of pilgrimages by the world's great business schools and financial minds for one simple reason... Thanks to its $50 Retirement Plan, WinCo has minted nearly 1,000 millionaires across America. Just consider that this year alone, WinCo will pay out $200 million in total cash towards the plan. Some of these individual accounts will amount to nearly $1 million each in cash benefits, according to Forbes. One of these folks is Cathy Burch, a typical worker from Oregon. At 42, she's worked a variety of front-line jobs including checker, shelf stocker, and inventory. These aren't jobs we'd normally associate with robust retirement savings, right?

In fact, the Employee Benefit Research Institute would tell you that most Americans in Cathy's situation either have no savings at all or an account such as a 401(k) containing less than $50,000. But as Cathy told Forbes in her own words, "I have almost $1 million. If I wanted to, I could retire right now." So what's different for folks like Cathy? She is a direct beneficiary of WinCo's $50 Retirement Plan. And she's not the only one...

James Lair works as a meat cutter in Nampa, Idaho. But there's something about him and his retirement account that you probably wouldn't expect...

"I'm going to retire pretty well," he says. That's right; this unassuming meat cutter is pretty much a millionaire thanks to WinCo's $50 Retirement Plan. These are not hotshot Wall Street investors or day traders... These are everyday working folks who were smart enough to take advantage of a little-known retirement perk offered by just a few American companies. Sometimes all it takes is a little bit of "smarts" to leap forward. And many Americans are now taking that leap because Social Security and typical 401(k) plans just don't cut it these days... Never in the history of finance would a small amount of cash like $50 or $100 become the buck stop for a lavish retirement. But thanks to an unadvertised plan endorsed by just over 100 unpopular and sometimes unheard-of companies, many everyday Americans are building thousand- and sometimes million-dollar portfolios in record time... And all it takes is a small amount of money, along with your signature on a form that you send to the company. Cathy Burch and James Lair are hardly the only ones making it out with plenty of "green" for retirement. Since I began researching this underground investment, I've discover hundreds of stories that would make your hair stand on end... Millionaires are being made out of folks who had no idea they would someday amass a fortune.

I am sure you've never heard of a company called Central States Manufacturing Co. based in Lowell, Arkansas. The company doesn't have any conventional competitive advantage — no important patents or intellectual property, nor any exclusive technology or equipment. It's not even listed on the S&P 500. It's just a steel-and-metal roofing company. Nothing "sexy" about it. But the company's approach to on-time delivery and service has made it cash rich. And it certainly has passed on the wealth to some Americans who are part of its $50 Retirement Plan. Folks like 60-year-old Aaron King, who piled up a solid $1.25 million in cash benefits thanks to Central Sales' $50 plan. As Aaron puts it: "Most of the people who are my age, in my Sunday school at church... they've worked as hard as I have and most of them have nothing. I almost feel guilty." Marcus Headrick is just 33 years old, but his retirement also looks brighter than that of most Americans. He's amassed $250,000 and is well on his way to a solid retirement. "Most of my friends don't have anything for retirement," Marcus told Forbes. Even Home Depot created an estimated 1,000-plus millionaires as a result of this underground retirement plan, according to the Florida Times. The question is, why are these not-so-mainstream companies paying so much cash to naïve and sometimes-reclusive individuals? Where is the money coming from? And why, for heaven's sake, haven't you heard of this before? A couple things first...

When our investigations lead to this moneymaking idea, we learned that it was one of the most discreet investments under the sun. Why? For years, brokers have lobbied Washington to shut down America's $50 Retirement Plan simply because too many folks are getting rich outside of Wall Street. Individuals who sign up for this plan deal directly with the company. As the Wall Street Journal puts it: "Because brokers, fund managers and other middlemen can't make any fees or commissions, you won't hear about the secret from these middlemen." We even spoke to one financial insider who admitted as much... Tax and pension attorney Chris Egoville sat down with us to break down why brokers are so scared of those $50 Retirement Plans. Financial brokers make their money by selling you a product... One of the unfortunate pieces of financial services is that it is really a sales-driven business. A broker by definition is a salesperson. They're not going to be compensated the way that they want to be compensated if you invest in a $50 Retirement Plan. Brokers are self-interested... it probably isn't appropriate for someone giving retirement or long term savings advice to be compensated the way brokers are. It's just not impartial. The other weird thing I discovered is that the U.S. government has a chokehold on these $50 Retirement Plans. Congress hates them enough to consider wiping them off the grid entirely, even if they're legal according to U.S. law. That means companies who offer this plan cannot advertise it to the public. Put simply, SEC rules won't let them. When this plan was approved by the SEC, the conditions prohibited the companies from advertising the plans, and usage was limited to people who worked with the companies and the ultra-wealthy. But it gets even more bizarre, especially when you consider that this $50 Retirement Plan is doing better than 401(k)s or IRAs, regular dividends offered by blue chip companies, bonds, CDs, or anything remotely close. Just last year, President Obama launched his new MyRA idea... another type of retirement plan with all the "benefits" for everyday Americans. Well, it's just another red herring to push for a full shutdown of $50 Retirement Plans, if you ask me. Chris Egoville told us that not only is MyRA a "terrible idea," but it is also the "surest way to lose your money." But until MyRA becomes a reality, anyone with the right information can legally open a $50 Retirement Plan and blissfully make hundreds of thousands of dollars, even a million, that can be used help you travel well, eat well, and take care of yourself in your golden years.

The great thing is that there are no age or income restrictions whatsoever to open a $50 plan. That's why it's a far better and more profitable way to collect steady income when you need it most. It's something that could forever change the way people in America retire. The problem is, the average citizen just doesn't know it exists. According to the Federal Reserve, the value of a typical 401(k) is about $120,000. That's almost nothing if you're looking to retire anytime soon. And it's 10 times less than the $1.1 million you could collect through a basic $50 Retirement Plan. If more Americans knew about this $50 Retirement Plan, we wouldn't be looking at a time when ordinary people are forced to work into their 70s (or even 80s). The best part is, most plans allow you to start with as little as $50. You can also start as high as $100, $500, or with any amount you want to. It really comes down to what you can afford at the time. You can hold multiple accounts if you're so inclined... and you can access the money you've saved anytime you want without any penalty whatsoever. Now, normally, as a financial analyst with a journalism background and one who's used to writing about breakthrough investments most people have never heard of... I'd be the first to be skeptical about something as secretive and financially rewarding as the $50 Retirement Plan. After all, there are enough "get-rich-quick" schemes out there already. But I learned that investors like Bill Gross endorsed $50 Retirement Plans over the years. Warren Buffett himself holds several of these accounts, too. Of course, these are influential investors with a lot of capital at their disposal. But plenty of everyday Americans with little money are secretly tapping into this plan as well and raking in over $1.1 million along the way... sometimes more. For instance... A $10 million fortune $180 turned into $7 million A millionaire in the making But here's what's really mind-blowing... We live in a world of information, right? So why do so few people know about these investment plans? Well, don't expect to hear Lowe's, WinCo, GE, Coca-Cola, Sempra Energy, Novartis, or any of those rich American companies advertise their $50 plans. It's against the law to do so. You won't even see any mention of these plans in their financial statements sent to their other regular shareholders. Many of the companies who offer this plan don't say a word about them on mainstream publications like the Wall Street Journal or Forbes. Plus, there are only about 100 companies that can offer you a shot at this plan. Now can you see why practically no one knows this program even exists? Well, I've created this presentation to show exactly how these plans work, who exactly is offering them, how much money you can make, and when you can expect to collect your payouts.

My name is Jimmy Mengel. You may have seen me hobnobbing with the financial elite on CNBC's Closing Bell... Or you may have heard of me as the architect behind the wildly popular finance and investing website Wealth Wire, where I brought readers the story behind the mainstream financial news every single day. I've spent my entire professional career researching and writing about little-known opportunities in the financial arena. Today, because of my experience, I'm managing editor of one of the country's largest independent financial boutiques, filtering obscure moneymaking ideas to our followers. I head the Outsider Club and our financial planning advisory, The Crow's Nest. As a trained journalist, I've gained a reputation among my peers for digging like a sleuth to uncover under-the-radar moneymaking loopholes in financial back doors that most people never hear of... In other words, I don't follow the crowd. The real money is always in the investments you've never heard of. That's how the rich play the game. For instance, last year I discovered a greedy way to play silver that doubles your return compared to buying silver the regular way. It's a very simple tool to maximize silver's inevitable returns over the coming years... In short, this investment phenomenon allows you to earn 2% every time silver spikes 1%. Another unconventional investment I discovered is a way to get into the collectables market. Through hard research, we tapped the resources of a collectables company that has authenticated and graded more than $27 million coins — worth a total of $27 billion. The company's card experts have certified more than 20 million trading cards, autographs, and other valuable memorabilia, exceeding $1 billion in worth. It's already up 70% in just a few months, and to top it all, my followers are enjoying a juicy 7.4% dividend, a return that's almost unheard of in the regular market. I've been furnishing my readers with these unorthodox — but incredibly safe — investment ideas that could have a huge impact on their financial goals. I am not one to follow the mainstream when it comes to money. That's the route to the poorhouse. Folks who want to stick to conventional investment ideas can buy a CD and be happy with a 2% return forever or follow the herd in the stock market. But if you want to beat the market at its own game and stay ahead of everyone else — instead of playing "catch-up" — then this presentation is your gateway to financial freedom. When I heard about the $50 Retirement Plan that has the potential to make Social Security, IRAs, and 401(k)s a thing of the past... I went to work right away to uncover how you could open one today and possibly build a million-dollar fortune like the folks I told you about. So what exactly are $50 Retirement Plans, and how can just $50, $100, or a small $180 multiply into as much as $7 million like it did for Grace Gray? You see, a $50 Retirement Plan is a corporate perk that was once reserved only for the rich executives of companies... And even though companies are forbidden from publicizing this safe and lucrative retirement plan, nowadays, anyone can start a plan with a company of their choice. This plan is specifically designed for people who want to start out small but accumulate thousands — even hundreds of thousands — without risking ANY money.

There is no investment under the sun that is safer and more consistent than these plans. Not options, regular dividends, blue chip stocks, penny stocks, or anything else... In short, a $50 Retirement Plan is an investment vehicle that multiplies small amounts of cash through what's called the "Rule of 72." It's a mathematical phenomenon used in elite financial circles to determine, with amazing accuracy, your profit's doubling effect or compounding periods... Or how many years it will take for a currency's buying power to be cut in half.

Words alone cannot do justice to the compounding force behind this rule... But famed scientist Albert Einstein tried when he said, "Compound interest is the ninth wonder of the world. He who understands it, earns it... he who doesn't, pays it." Well, the Rule of 72 is the secret booster behind $50 Retirement Plans. It's the compounding effect on your money that makes this plan trump IRAs, 401(k)s, or Obama's ready-to-fail MyRA. In fact, this force is so powerful that I think the government is deliberately keeping it from you. I say that because if the masses actually knew of the income this multiplying effect could deliver, they would immediately demand an end to Ponzi schemes like Social Security. While the rest of the investing public fights for the same pool of risky stocks and low-return 2% CDs, I discovered people from all walks of life who secretly own those safe $50 Retirement Plans.

And as I said before, unlike with 401(k)s, IRAs, or even Social Security, there's no age limit to owning a plan.

Consider the story of Alisha Brown. She was a first grader when she was enrolled in the $50 Retirement Plan of Coca-Cola as a present for her sixth birthday. For Alisha's family, it was a giant first step towards securing her financial future. When Coca-Cola sent her the certificate of ownership for her $50 Retirement Plan, so monumental was this moment that it was framed with an engraving of the first part of Deuteronomy 8:18: "You shall remember the Lord your God, for it is he who gives you power to get wealth."

It didn't take long before Coca-Cola mailed her documents to welcome her as a proud member of their retirement program.

Her plan was opened with less than $50. Today, it's worth nearly $8,000. If the account continues undisturbed until she graduates college, Alisha will have roughly $15,400, which will be a great gift along with her college degree. Just imagine if your child or grandchild had that privilege... In a moment, I'll show you how you can open a $50 Retirement Plan that will generate $25,000... $50,000... $270,000... or even $1.1 million more than what you're getting today in your traditional IRA or 401(k). You'll know which company to contact, and applying is as easy as filling out a form. There's a line at the top for your name and address. You sign at the bottom... enclose a check for an initial payment, which could be as low as $50 or $100... then drop it in the mail. From there on, you can expect your small payment — or whichever amount you decide to start with — to multiply as if on autopilot. But here's the real question: How did a retirement plan so rewarding and so secretive get started in the first place... and how can you take advantage of it today?

More than 50 years ago, some of America's biggest companies started offering their executives and other employees a special perk. In short, they were allowed to buy shares of the company DIRECTLY from the company, usually at a steep discount. A few companies like General Electric, Kellogg's, AT&T, Johnson & Johnson, and Procter & Gamble began offering these perks. As you may have guessed, these shares became part of the company's $50 Retirement Plan. Over time, that perk was extended to the wider public, allowing them to get in on the program. It was a way for a company to grow a stable of loyal shareholders and raise money away from greedy brokers and the stock market. You could only participate in this program by buying the shares directly from the companies offering the plan. By now, you can see why brokers are furious about it and have dogged the government to shut down this $50 program... and leave Americans to rot with the likes of IRAs and 401(k)s. Do you think they'll ever tell you about $50 Retirement Plans? Don't hold your breath. But guess what? It's time to stop paying needless broker fees. That's exactly what Anne Scheiber did.

Scheiber was an IRS auditor, yet she didn't have much to rely on for retirement. She was badly burned by brokers, so she resolved to never rely on anyone for her own financial future. What happened next is shocking, for lack of a better word... Using a measly $5,000 she had saved and a pension of roughly $3,150, she plowed it all into a $50 Retirement Plan and built a $22 million fortune from her tiny New York apartment. Never before has any investment in this nation's history given so much investing freedom to average Americans like $50 Retirement Plans. But there's one thing you must be mindful of: You can't wait one minute more to start a plan. Obama is already on track to shut down every retirement plan that keeps your money from the government. In fact, the government could decide one morning to shut down the $50 Retirement Plan for good. So you must hurry to grab this ticket to a safe and worry-free retirement. Here's how it works...

To open a $50 plan (and I'll show you exactly which companies offer the best plans), you must buy ONE share of stock. That's it. Your ONE share of stock generates dividends. But here's where it gets really good... "These plans permit shareholders to automatically plow their dividends into the buying of additional company shares. In some cases, there's a discount on the price of those shares," as the Chicago Tribune puts it. The more shares you get, the greater your dividends multiply over time. Keep in mind, these are preferred dividends — they're not like the ordinary dividends regular investors get when they buy a stock. These preferred dividends go straight into your $50 account, and they are like dividends on steroids. They multiply quickly without you doing any work whatsoever. That's a great way to start preparing for retirement even if you don't have a lot of cash on hand. But if you can afford it, you can begin your plan by buying more than one share. For example... Let's say you saved $3,000 and started a plan with one of my favorite dividend payers, Duke Energy Corp. (DUK). That initial investment of $3,000 would have bought you 176 shares of DUK at the time, each one earning a dividend yield of 5.4%. That dividend would eventually multiply five times. Your $50 plan would earn you a tidy $1 million payday as long as you simply let your dividend multiply in the plan and add a monthly contribution of just $80. You could have earned a yearly dividend stream of $50,845 without lifting a finger. This is way better than the returns you'd get from the S&P 500's measly 10.4% over the last three decades. Remember, this is something you cannot do with regular dividends if you buy the stock via the stock market. You can only get that "dividend multiplier" when you open a $50 Retirement Plan.

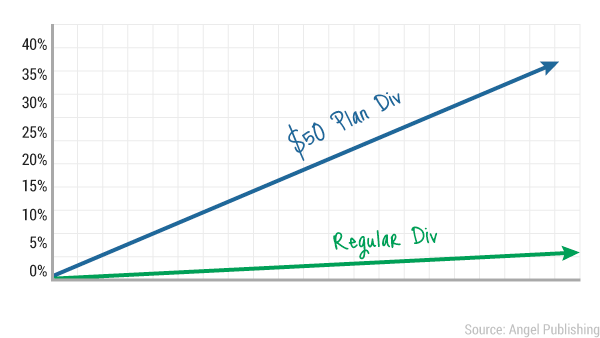

Let me show you how it works... Some folks are happy with the 3% dividend advertised by Johnson & Johnson. If you were to invest $5,000 into Johnson & Johnson the regular way — through your broker via the stock market — your profits would have been a measly $150 in annual dividends. To some folks, that's a big deal. But that's probably because they don't know about the company's $50 plan that allows you to collect 36%... from the exact same shares over the long haul.

This effectively translates into a whopping $1,950 in annual dividends that gets reinvested in your $50 plan to buy more shares directly from the company and build your retirement portfolio on solid ground. And that's regardless of what happens to Social Security, IRAs, 401(k)s, the stock market, or the wider economy. Your $50 plan must get paid by law. Same thing could have happened had you tapped into the $50 plan of Pepsi Co. Most Americans take home the company's 2.9% dividend and stash it away hoping to build something for rainy days.

Another good example is AT&T's $50 plan, where your dividend would have been seven times more than the company's regular dividends. While the company currently yields a 6.7% dividend, its $50 plan holders are bagging a whopping 43% instead.

Throughout my career as a financial analyst, I have seen my fair share of investment fads, and I can tell you there aren't many investments out there that are safe. But $50 plans are just about the safest and most consistent way to multiply your money regardless of what happens in the market.

These plans are so solid that even if the company's stock price stumbles, your $50 plans remain untouched. Remember the earlier story of 6-year-old Alisha Brown, who owns a $50 plan with Coca-Cola? Well, her plan was opened with one share of Coca-Cola's stock, which cost less than $50 at the time. Today, the account is worth nearly $8,000. Thing is, Coca-Cola still trades today at around the same price it did when the plan was started years ago. Nothing fantastic has happened to the stock price. Not only that... We've experienced the September 11th terrorist attacks... the rise and fall of the housing bubble... the stock market collapse of 2008... two wars waged halfway around the world... expanding federal deficits... and near double-digit unemployment. Despite all of these woes, Alisha's plan grew at roughly 6% compounded. But this is not just a stroke of good luck. A man named John Kayson bought 105 shares of U.S. Bancorp in one of his $50 Retirement Plans simply as an experiment. He paid $27.29 per share and had a total cost of $2,865. The stock crashed (along with everything else) to $23.62 as of the close of the markets on November 19, 2008. Folks who owned the stock via the stock market and through a broker saw a 13% drop in price and lost a huge chunk of their savings. Yet John Kayson's $50 plan showed a 45.348% gain while everyone else got waxed in the market.

This brings me to another point that highlights how these $50 plans are better than IRAs, 401(k)s, or any other retirement plans... When you open a $50 plan, remember, you buy shares directly from the company. If the stock price of the company falls, the multiplying dividends simply buy more shares on the cheap... accelerating higher percentage dividends for the future. John Kayson originally bought 105 shares. When U.S. Bancorp shares fell, he automatically owned 124.36474 shares. That's nearly 20 shares more than he originally purchased. Did he get more dividends on those extra shares? You bet. He might be a millionaire in the making as a result. His interest begins to earn interest on itself. Bottom line: Falling stock prices don't affect $50 plans in any negative way at all. In fact, they allow you to add shares at the cheapest possible price. From the looks of it, if too many Americans know about $50 plans, it could make the stock market obsolete. And that's true in a sense. Maybe that's why the government is working overtime to keep this a secret.

Here's the thing: I've only begun to scratch the surface of how great these plans are at helping you accumulate wealth. If at this point you want to fold in your IRA or your 401(k), I won't blame you, considering that $50 Retirement Plans outperform them by 10-fold in some cases. And with retirement on the horizon, the earlier you start, the better you can let your dividends accumulate to hundreds of thousands or even a million dollars. I don't know about your personal financial situation. But here's some shocking news when you think of it... 72% of Americans say they will have to work until they are at least 80 because they have not saved enough to retire, according to USA Today. Bottom line: Now's the best time to open a $50 plan. And holding back a day longer is like throwing money away. Plus, you never know when the government will shut down this program. Nothing this good can last forever. Right now, you may even want to start one for your children or grandchildren. It will give them a jump-started financial advantage most kids never have. And you can do this with as little as $10, $50, or $100. Heck, you could start with $500. In fact, you can start a $50 plan today at a discount... Because some companies secretly offer a 5% discount to begin a plan with them. I'll reveal a full list of companies that allow this technique and a full list of companies that will "pay you to invest in them." I've just written a special report with all the details, starting with three of those companies that offer the best $50 plans today: $50 Dividend Booster #1 This rock-solid company allows you to take full advantage of a $50 Retirement Plan. Not only does it offer free dividend reinvestment on its 2.4% yield, but it also gives you a 5% discount on stock purchased directly this way. That is a smooth 7.4% dividend that will multiply into over 20% over time. Not to mention the trading fees you'll save. This company has raised its dividend every year for the past decade. And it plans to keep doing so. When looking to buy any company for retirement profits, the key isn't to look at how large the dividend yield is but to examine how many years the company has raised the dividend and the future chances of it continuing to do so. That's why my second $50 retirement company is a gem. $50 Dividend Booster #2 This company is a fully integrated, self-administered, and self-managed real estate investment behemoth. It could sound "boring" at first. But don't let it fool you... It's the largest company of its kind in the country. It is flush with cash and has no problem passing a huge chunk of it to investors like you. First thing you have to know is that this company lets you in with a 2% discount when you buy into its plan. You can enjoy a nice 3.3% dividend that will multiply more than five times once your retirement plan kicks in. But you'll have to hurry — forget Wall Street and buy your shares directly from the company to get plugged in. $50 Dividend Booster #3 While many energy companies are quite popular, this isn't one you'll hear about. Yet it's a company that's followed by the Who's Who of the financial world... firms like JP Morgan, Wells Fargo, and Morningstar, Inc. What makes this company unusual is that it allows you to enroll in its plan with a 5% discount. That means you can buy shares at a discount and reinvest your payments into the plan to grow your account at a You can get the full details on how to proceed with each of these companies in my new research report: "The Forbidden Secret to Retire a Millionaire." Once you get this groundbreaking report, browse it. Take action. Get invested in a $50 plan, and watch your retirement plan sizzle to five, even 10 times the size of your traditional IRA or 401(k). You won't have to worry about Social Security or the lagging retirement plans that send millions of Americans back to work well into their 70s. Best of all, I'll be sending you this report FREE of charge. No strings attached. You can claim your free report the minute you take a look at my research newsletter, The Crow's Nest.

What exactly is The Crow's Nest about... and where did it get its unusual name? In the days of naval conquest, explorers were only as good as their lookout... The best lookouts were built atop the highest point of a ship's mast, an area aptly named after the birds that would often perch there: the crow's nest. While these were dangerous to climb, it was there that the lookout could see for miles out and identify any hazards, traps, or storms — well before they threatened the ship. Not only did they spot potential threats and dangers, but a good lookout could also spy treasure, land, and opportunity to safely guide the captain to riches and prosperity. It is for this reason that the success of most ships depended on the crow's nest. As you can imagine, today's financial landscape has much in common with the high seas of pirate lore. The world of personal finance is filled with tricks, traps, fees, and scalawags... But instead of Blackbeard coming for your booty, you have bankers, money managers, and government officials with their beady eyes fixed on emptying your pockets. It's time to wake up and take matters into your own hands — not just with investments, but in every financial aspect of your life. After all, you are the captain of your own ship. But a captain is only as good as his crew... and that's why we at The Crow's Nest are ready to break our backs for you to help you reap the rewards of financial security. The Crow's Nest will teach you how to completely take control of your finances — from buying stocks to plotting your retirement, taking advantage of tax breaks, and simply plugging the money leaks that threaten to sink you. We're not here to follow the crowd. You'll never find the super-rich glued to the TV screen like a bunch of lemmings. The best investments are those you'll never hear about or think you could participate in. But here at The Crow's Nest, no investment is off limits. That's why we dig like sleuths to unearth the most obscure and potentially rewarding ones. That's how you'll get rich in this game. Today, you're about to start with one of those investments that most Americans have NEVER heard about yet that has created millionaires whose wealth outlived them. Your free report, "The Forbidden Secret to Retire a Millionaire," is the gateway to taking back control of your financial future. If you're ready to chart the course of your retirement, then $50 Retirement Plans are just the beginning.

Over the last few months, I introduced my followers to another investment strategy that pays steady income no matter what happens in the market. It started at an investment conference in Toronto, where I delivered a presentation and tossed out the term "Dividend Aristocrats" like everybody knew what I was talking about. But after the talk, there was a crowd of people lined up with one major question... "What are these fabled Dividend Aristocrats you speak of?" I should have been smart enough to know that most investors have no idea what the best investments in the world are... and it's no fault of their own. After all, the best stuff is always kept under the radar. You see, I've been compiling research about a unique brand of companies that are hailed in the financial world as the "Dividend Aristocrats." These are not your average dividend players that everyone and their neighbor taps into. These trailblazing companies have increased their payouts every year for the last 25 years. And they're the only ones who could afford to do so. The payouts are enormous, to say the least. Sometimes you could collect as much as 12 payouts a year. If income amounts like $17,544 sound good to you, or if collecting checks for $14,143 sounds too good to be true, then this program is for you. Heck, I have seen folks rake in as much as $110,000 in dividend payments over the last two years alone. And that can amount to a considerable account come retirement. The strategy involves adding a few of these isolated companies to a portfolio that works like your own personal "mutual fund" of dividends on steroids. While this strategy won't make you rich overnight, it will let you sleep soundly knowing your money is growing and paying you constantly whether the stock goes up or down. Bottom line: When you join the Dividend Aristocrat program, you'll learn how to start collecting regular dividend payments at far better yields than those pulled in by average investors. I'd like to invite you to become a "Dividend Aristocrat" — the rare breed of American investor who collects thousands of dollars in income every month — no matter what the overall market is doing. You'll know which companies are involved... how to begin collecting those higher-than-usual payouts... and how much you can expect to make. Everything you need to know is in your free report: "Banking on Dividend Aristocrat Payouts." And like your first report, "The Forbidden Secret to Retire a Millionaire," my dividend report is also yours free of charge as part of your trial subscription to The Crow's Nest.

But that's hardly all you will get in your welcome package to The Crow's Nest. You'll also receive 12 monthly issues of The Crow's Nest, including unbiased and obscure investment ideas that have made millions yet remain buried because "you're not supposed to know about them." Get ready for a front-row seat to the best investment ideas available. You'll get your very own password and username to The Crow's Nest platform, which gives you access to my Research Reports... Newsletter Archives... Portfolio... and Research Videos. Most importantly, I will tell you what to buy and sell at the most opportune time. There is no guesswork on your behalf. If there's a moneymaking move that requires immediate attention, you'll get a quick alert to take action. Got questions? There's a support staff to deal with any queries you may have. Another good thing is the super-low price I've asked my publisher to set in stone for you. But before we get to that, there's another investment idea you must know about.

What if I told you there is a way to lock in 11.05%, 14.05%, or 17.33% annualized returns, and the company paying is legally obligated by a contract to send you monthly payments? You see, I've discovered a very special type of bond that cuts out the greedy banking establishment and the tax-hungry U.S. government once and for all. It's perfectly legal, and it's sanctioned by the Securities Exchange Commission (SEC) and the Internal Revenue Service (IRS). And it pays interest every single month. That interest adds up to as high as 17% annual yield. That's almost five times more than the average yield of the S&P 500. It's an investment opportunity that became available in 2007, and many folks have no clue it exists — especially since it's not available in every American state. But your broker and banker will refuse to ever discuss this opportunity. They hate it. Don't let that stop you from making a bundle tax-free. The best part is, you can start with just $25 and watch it grow steadily into a solid account — better than most regular dividends. It's a perfect opportunity for folks who want to start out small with little risk and grow a sizable amount of money on autopilot. If you want to up your stake... no problem. That option is available, too. And while I can't say much about it here, I can tell you it's a special kind of Private Note offered by one high-paying dividend company. Everything you need to know to take advantage of this obscure investment is readily available in my new research report: "LC-25 Contracts: The Easiest Passive Income You'll Make." And like your first two reports, it comes to you free of charge when you try The Crow's Nest risk-free.

How much does it cost, and how can you lock in your subscription today? Today, you can get The Crow's Nest and everything I've mentioned for just $69 a year. That's less than $0.25 a day! In other words, for less than the price of a stick of gum, you can begin to receive my Crow's Nest advisory to learn investment strategies like $50 Retirement Plans that can make you hundreds of thousands of dollars in retirement cash. Remember, as soon as you subscribe to The Crow's Nest, you will have immediate access to your three free reports:

$50 Dividend Booster #1: This plan offers you the perk of "getting paid to invest," with an initial 5% discount to get started. You'll start off with a sizzling 7.4% dividend that will definitely multiply to over 20% over the long haul — a send-off to a golden retirement. $50 Dividend Booster #2: Get in with a 2% discount and start off with a 3.3% dividend and watch it multiply five times as you hold onto this plan. This real estate company is flush with cash and is passing it along to folks like you. $50 Dividend Booster #3: This is the one plan you must own right now before it's too late to get in. This company is rock solid and offers a huge benefit to your plan. You can get in at a 5% discount while you reinvest your payment for more cash.

Lock in your subscription to receive The Crow's Nest today. Your success is guaranteed. Here's what I mean... By subscribing today, you're only agreeing to try my research for the next three months. If during that time you're not completely satisfied, you're free to ask for a full refund. Last thing I want is for you to pay for something that can't help you get rich. But I want to take it a step further... Regardless of what you do, your free reports and any investment intelligence you receive during your time with us are yours to keep. I can't be fairer than that. You have to take a bold step to secure your retirement, and the best time to get started is today so you can see those dividends piling up in your new $50 Retirement Plan. Remember, there is a lot of vested interest in seeing $50 Retirement Plans go away. You just never know when the government will cave in and ban those plans for good. You must hurry to start your plan now... for yourself or your children. I'm giving you all you need to know to take back control of your finances. To open your plan and get set on the right path to retire free of money worries... Godspeed,

Jimmy Mengel This email was sent to pascal.alter@gmail.com . You can manage your subscription and get our privacy policy here. Outsider Club, Copyright © 2015, Angel Publishing LLC, 111 Market Place #720, Baltimore, MD 21202. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Outsider Club does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it.(...) |

faster rate.

faster rate.

Brak komentarzy:

Prześlij komentarz